"The United States has imposed sanctions on cryptocurrency exchanges that are utilized by Russian darknet markets, as well as financial institutions"

Foreign Assets Control (OFAC) within the U.S

The Office of Foreign Assets Control (OFAC) within the U.S. Treasury Department has imposed sanctions on three cryptocurrency exchanges for their involvement with Russian dark web markets and banks that have been designated by OFAC.

The initial entity, Bitpapa IC FZC LLC, operates as a peer-to-peer virtual currency exchange specifically targeting Russian nationals. This platform has facilitated numerous transactions totaling millions of dollars with two OFAC-designated Russian entities, Hydra Market and Garantex.

Obshchestvo S Ogranichennoy Otvetstvennostyu Tsentr Obrabotki Elektronnykh Platezhey (TOEP)

The company known as Obshchestvo S Ogranichennoy Otvetstvennostyu Tsentr Obrabotki Elektronnykh Platezhey (TOEP) functions as a virtual currency exchange under the names Netexchange and Netex24. It has been officially penalized for facilitating digital transactions involving cryptocurrencies and rubles with entities designated by the Office of Foreign Assets Control (OFAC), namely Hydra Market Sberbank, Alfa-Bank, and Hydra Market.

Hydra Market

Hydra Market, a prominent darknet market, held the distinction of being the largest of its kind globally. Operating within the Russian dark web, this platform facilitated the illicit trade of narcotics and facilitated money laundering activities. Remarkably, Hydra Market achieved a staggering turnover of $1.35 billion in the year 2020. Furthermore, it boasted an extensive network of 19,000 registered seller accounts, catering to a vast customer base of at least 17 million individuals across the globe.

Hydra additionally provided illicit access to stolen databases, counterfeit documents, and services for hire related to hacking. In April 2022, the German authorities, in collaboration with the United States, conducted a coordinated operation to confiscate Hydra Market's servers and seized 543 bitcoins derived from its earnings, valued at approximately $38.5 million at present.

Crypto Explorer DMCC (AWEX) functions as a cryptocurrency exchange in both Russia and the United Arab Emirates, enabling seamless conversions between virtual currencies, rubles, and UAE dirhams.

AWEX also offers cash services in Moscow and Dubai, enabling customers to deposit funds onto credit cards issued by Sberbank and Alfa-Bank, both of which are designated by the Office of Foreign Assets Control (OFAC) as Russian banks.

The Office of Foreign Assets Control (OFAC) has imposed sanctions on Bitpapa, TOEP, and Crypto Explorer due to their engagement in the financial services industry within the economy of the Russian Federation.

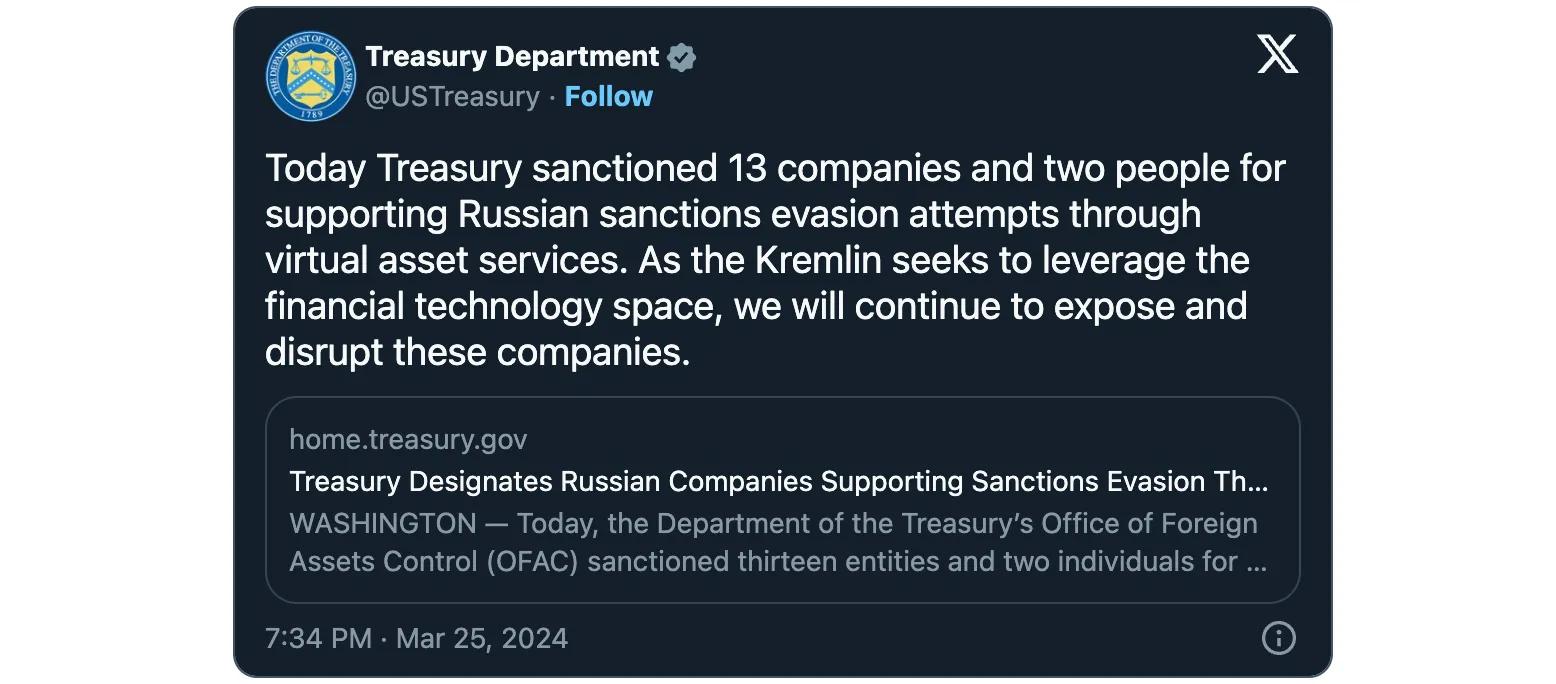

The Office of Foreign Assets Control (OFAC) has additionally identified several Russian financial technology companies and their proprietors for collaborating with OFAC-designated entities such as Rosbank, VTB Bank, Sberbank, Sovcombank, and the Central Bank of Russia in facilitating the circumvention of sanctions by Russian entities and individuals.

Brian E. Nelson, Under Secretary of the Treasury for Terrorism and Financial Intelligence, stated that Russia is progressively resorting to alternative payment methods in order to bypass U.S. sanctions and sustain its military campaign against Ukraine.

The Kremlin's efforts to utilize entities in the financial technology sector are being closely monitored by the Treasury. It is the ongoing objective of the Treasury to uncover and impede the activities of companies that aim to assist sanctioned Russian financial institutions in reestablishing connections with the global financial system.

In light of the recent imposition of sanctions, it is hereby declared that any assets and interests held within the United States, which are associated with individuals and entities designated as such, shall be promptly frozen. Furthermore, entities that possess a minimum ownership stake of 50% by individuals subject to this blocking measure shall also be subjected to the aforementioned freeze.

Furthermore, the engagement in transactions pertaining to assets of individuals subject to blocking will be strictly forbidden unless explicitly authorized by the Office of Foreign Assets Control (OFAC). Financial institutions and entities involved in dealings with sanctioned individuals or entities will face potential exposure to sanctions or enforcement measures.

The Office of Foreign Assets Control (OFAC) had previously imposed sanctions on the cryptocurrency exchange Garantex, based in Moscow, in April 2022. This exchange was found to have connections with illicit transactions carried out on the Hydra Market.

Even more Furthermore, the North Korean Lazarus hacking group has identified and designated the Sinbad, Tornado Cash, and Blender.io cryptocurrency mixing services as instruments for the purpose of money laundering.